FutureEnergyBonds

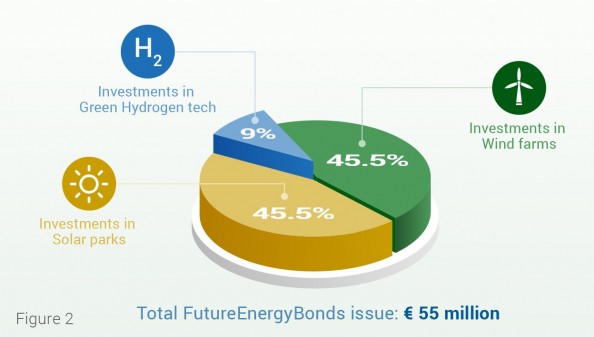

Renewable energy is evolving more today than ever before.1 FutureEnergyBonds are 100% green bonds that allow you to invest in a combination of high impact development in green hydrogen technology with high-quality wind turbines and solar parks located onshore in Germany. A combination between the future of our energy supply in hydrogen, with a stable basis in the current renewable energy solutions that produce the green energy to provide that future. A profitable investment that ensures your personal contribution to the transition to sustainable energy and green hydrogen. FutureEnergyBonds are available for a total fund size of € 55 million; 550 FutureEnergyBonds, € 100,000.00 each.

When you participate in FutureEnergyBonds, you are granting a loan to FutureEnergyFund N.V.. 9% of the funds are directly invested in participations in companies that work to evolve green hydrogen technology. FutureEnergyFund N.V. combines 91% of proceeds of the FutureEnergyBonds issue with bank loans to invest in several wind (45.5%) and solar (45.5%) parks in Germany. You will receive a 7.5% fixed interest rate per annum over a maximum period of 5 years. A base interest that is ensured by the investment in wind and solar. The total return may be increased subsequently due to potential one-off bonus interest up to 12% at the end of the duration, as a direct result of selling the participations in green hydrogen technology.

The information on this website is simplified advertising. The Investment Memorandum contains detailed information about FutureEnergyBonds. Potential investors should read the Investment Memorandum to fully understand the potential risks and benefits.

-

Interest

7.5 %, fixed, per annum, with quarterly payments

-

Maximum duration

5 years

-

Total bond issue

€ 55,000,000 (550 FutureEnergyBonds)

-

Nominal value per bond

€ 100,000 (one hundred thousand euros)

-

Currency

Euro (€)

-

Emission costs

None, exempt

-

Redemption 100%

Yes

-

Bonus interest

Yes, one-off, up to 12%

iBonus interest - Extra informationAvailable profit coming directly from the increased worth of the investment in green hydrogen technology is partly distributed pro rata among the participants. This profit can be made by selling the participations in green hydrogen technology companies at the end of the term of the FutureEnergyBonds. Therefore this is a one-off interest payment depending on the exact profit made by selling the participations in development of green hydrogen tech after 5 years. There are three possible interest scenarios: A 0%, B 7.7% and C 12%.

Investment Criteria

-

Green Hydrogen

Support hydrogen as a future solution for energy.

iGreen Hydrogen - Extra informationHydrogen is the future solution for energy in mobility, heating and industry. Green hydrogen, also called 'renewable hydrogen', is hydrogen that comes from a renewable source and that is produced with sustainable energy. Unfortunately, most hydrogen is currently still produced using fossil fuels. Almost all hydrogen that is currently produced worldwide is therefore so-called "gray hydrogen". Gray hydrogen can currently be produced for approximately 1 euro per kilo. This is way cheaper than green hydrogen costing 3 to 6 euro’s per kilo. Technology should facilitate the situation that green hydrogen can be competitive at around 1 to 1.5 euro per kilo (based on reports by TNO2 and McKinsey&Company3).

The main way to make green hydrogen is electrolysis (powered by renewable energy), which splits water into hydrogen and oxygen. Elektrolyzers practically produce the green hydrogen. By significantly changing and improving the technology of the elektrolyzers, making them more efficient, green energy can be produced at a competitive price.4 FutureEnergyFund invests directly in companies that work exactly on these solutions.

Furthermore, if there is ample supply of green electricity (FutureEnergyFund is also directly investing in wind and solar), new efficient systems with improved processes producing on a larger scale, can already supply green hydrogen for 1-1.5 euro per kilo in 3 to 10 years.5

-

Goal

Invest directly in green hydrogen technology development companies and/or startups, improving electrolysis.

-

Hydrogen company

Based in Germany and/or other European countries and technology applies to specific areas.

-

One-off fixed bonus interest

There are 3 scenario’s:

A 0%,

B 7.7%

C 12%.iOne-off fixed bonus interest - Extra informationAvailable profit directly from the increased worth of the investment in green hydrogen technology after selling participations at the end of the duration of 5 years, is partly distributed pro rata among the participants. This is a one-off payment with three possible fixed interest scenarios.

-

Wind turbines (in Germany, onshore)

1. Existing turbines,on the grid, producing energy. Operational for a maximum of 12 years.

2. New turbines, in development stages, not yet on the grid, to be completed.iWind turbines (in Germany, onshore) - Extra informationWith new turbines in the final development stages (building permit has been issued), there is a construction and development risk until the wind turbines are connected to the grid. The advantage is that it is possible to purchase at lower costs. Therefore the return is relatively higher.

-

Wind turbine manufacturers

Top 5 and / or 12 other brands.

iWind turbine manufacturers - Extra informationThere are differences between manufacturers in the quality of the technology and the guarantees offered. When investing in the top 5: Enercon, Vestas, Siemens, Nordex or General Electric, assurance of stable functioning technology and availability is greatest. The 12 additional brands Vensys Energy, NEG-Micon, AN-Bonus, Gamesa, Senvion, Fuhrländer, Leitwind, Lagerwey, ENO, Südwind, Kenersys, Dewind also have well-functioning wind turbines, but the security is less than the top 5. However, the purchase costs are lower and the potential return higher.

-

Energy legislation

EEG 2017 and / or auction system.

iEnergy legislation - Extra informationThe German Erneuerbare Energien Gesetz 2017 guarantees wind turbines built on the basis of this scheme of a certain purchase with a fixed kWh price for a period of 20 years from connection to the grid.6 Newer variants of the EEG provide an auction system in which the price of the fixed kWh purchase is determined by means of an auction. In principle, this fixed price also applies for 20 years, but it is evaluated every 5 years, as a result of which the kWh price can fall or rise.7

-

Desired total capacity of investment in wind

Approximately 78.1 GWh annually.

-

Solar parks (in Germany, onshore)

Existing solar parks / solar photovoltaics (PV), on the grid, producing energy. Operational for a maximum of 12 years.

-

Solar parks manufacturers

Top brands and / or common use brands.

iSolar parks manufacturers - Extra informationThere are differences between manufacturers in the quality of technology. In top brands assurance of stable functioning technology and availability is greatest. Although differences in quality are not very large in solar technology. Common use brands also have well-functioning solar panels. It is all about the minimum capacity of energy that they provide. Purchase costs are lower and potential returns are higher in solar parks that cost less and provide the same capacity. Capacity is leading.

-

Energy legislation

EEG 2017 and / or auction system.

iEnergy legislation - Extra informationThe German Erneuerbare Energien Gesetz 2017 guarantees solar plants built on the basis of this scheme of a certain purchase with a fixed kWh price for a period of 20 years from connection to the grid.8 Newer variants of the EEG provide for an auction system with which the price of the fixed kWh purchase is determined by means of an auction. In principle, this fixed price also applies for 20 years, but it is evaluated every 5 years, as a result of which the purchase price can fall or rise.9

-

Desired total capacity of investment in solar

Approximately 105 GWh annually.

FutureEnergyFund

Transition to sustainable energy

Reducing CO2 emissions is essential for our future to maintain planet Earth as we know it today and to pass it on to future generations. We consider it to be very important to contribute to the transition to sustainable energy. The more people are committed to this mission, the faster we can achieve more impact on enlarging the green hydrogen supply and accelerating the energy transition.

Yes, please send me more information.

WindShareFund

WindShareFund took the initiative for FutureEnergyFund. The Netherlands based company opened their first investment fund in April 2015, investing in wind energy in Germany. WindShareFund realized four funds, with more than 1,500 participants in 29,400 Bonds. The company invested approximately € 25 million in wind turbines in Germany. The issuance of ClimateBonds with CSSF approved Prospectus was successfully completed on July 1, 2021.10

Climate Center Mariëndaal

FutureEnergyFund is managed from Climate Center Mariëndaal, the Netherlands, which is currently being developed by WindShareFund. Climate Center Mariëndaal realizes, in collaboration with the business community, governments, knowledge institutions and other stakeholders, a climate centre and (business) meeting place where sustainable development in a broad sense is central.11

Sustainable Development Goals

FutureEnergyFund contributes directly to the Sustainable Development Goals of the United Nations.12 Two of the concrete objectives supported involve climate action and affordable, clean energy. Would you like to participate in this activity and receive an attractive interest rate on your investment? Then register now.

- IRENA, Global Energy Transformation, A Roadmap to 2050, irena.org.

- TNO, From Grey and Blue to Green Hydrogen, tno.nl and TNO, Ten Things you need to know about Hydrogen, tno.nl.

- McKinsey&Company, Energy Insights Hydrogen, mckinseyenergyinsights.com and McKinsey&Company, Global Energy Perspective 2021, mckinsey.com.

- Roland Berger, Bringing Hydrogen into the Mix: Opportunities for Growth, rolandberger.com and Roland Berger, Fuel Cells and Hydrogen Applications for Regions and Cities Vol. 2, rolandberger.com.

- Industry & Energy, Nel targets hydrogen price to 1.5 dollar per kilo by 2025, industryandenergy.eu.

- Bundesministerium für Wirtschaft und Energie, Erneuerbare-Energien-Gesetz (EEG 2017), erneuerbare-energien.de.

- Bundesministerium für Wirtschaft und Energie, Gesetz zur Änderung des Erneuerbare-Energien-Gesetzes und weiterer energierechtlicher Vorschriften, bmwi.de.

- Bundesministerium für Wirtschaft und Energie, Erneuerbare-Energien-Gesetz (EEG 2017), erneuerbare-energien.de.

- Bundesministerium für Wirtschaft und Energie, Gesetz zur Änderung des Erneuerbare-Energien-Gesetzes und weiterer energierechtlicher Vorschriften, bmwi.de.

- WindShareFund website, windsharefund.com.

- Climate Center Mariëndaal website, climatecentermariendaal.com.

- United Nations, Department of Economic and Social Affairs, Sustainable Development Goals, sdgs.un.org/goals.

Risks

All investments involve financial risks. An investment in FutureEnergyBonds exposes you to debtor risk. As a result, you may lose (part of) your initial investment. There is also the risk that we will not be able to pay out (the full amount of) the interest or potential profit sharing, or that you will not be able to find a buyer in the event you wish to transfer prior to the maturity of FutureEnergyBonds. Please refer to the Investment Memorandum for a detailed overview of the risks and benefits.